Accordingly the GST state codes along with the alphabetical codes for various states are as follows. Dadra Nagar Haveli.

Documents And Procedures For Exporters Under Gst

Malaysias trade peaks at RM270 billion in two-year marathon growth MalaysiaNow.

. It applies to most goods and services. Capital acquisition GST item. Exempt GST print code Specify the print code that is used for exempt GST codes.

Malaysias total trade reaches record high of RM27039 bln in June. These are standard-rated supplies exempt supplies zero-rated supplies and supplies that are beyond the scope of Goods Services Tax. Attribution of input tax to taxable supplies.

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. Treatment of input tax attributable to exempt financial supplies as being attributable to taxable supplies. Disallowance of input tax.

The sac is strictly numeric and is six. Malaysia last reviewed 21 july 2021 sales tax. Malaysias total trade hits new high of RM2704bil in June The Star Online.

The MSIC 2008 version 10 is an update of industry classification developed based on the International Standard of Industrial Classification of All Economic Activities ISIC Revision 4. 938 ap bad debt relief calculation for im tax code. September 16 2021 Post a Comment.

Goods services that fall under each of these categories are pre-determined by the RCDM Royal Custom Department of Malaysia. The Service tax is also a single-stage tax with a rate of 6. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

Penalty Payment For Section 103A 103. Monthly Tax Deduction MTD 6. There are 23 tax codes in GST Malaysia and categories as below.

For example you make payment to vendors and you must also pay bank fees to banks. Concentrates of poppy straw. On the Tax Code page check the boxes of the properties that apply to the tax code.

The Malaysia Standard Industrial Classification MSIC search engine system or e-MISC was developed to facilitate the users to find the relevant industrial code. This tax is not required for imported or exported services. For more information about tax code properties see Tax Code Properties.

Tax Instalment Payment Individual. State code list under GST. Bg bangladesh iv code divoire ivory coast.

To understand how NetSuite uses the tax codes to get the values for the Malaysia GST-03 Return see What goes into each box - Malaysia GST-03 Return. The two reduced SST rates are 6 and 5. Purchases with GST incurred at 6 and directly attributable to taxable supplies.

Find out more online here. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to. Non-applicability to certain business.

Import of goods with GST incurred. Machines for transcribing data on data media in coded form. 8 rows GST code Rate Description.

Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. Export of goods from Malaysia to Designated Areas. Here is a list of GST codes and terms that comply with the Australian BAS.

Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Magnetic or optical readers nesoi. Tax Instalment Payment Company.

Meaning of longer period. Per Malaysia GST regulations GST will be applied to the bank charge. 9 rows GST code Rate Description.

Claim for input tax. 6 a list of the gst reliefs is available in the gst imports relief order. Real Property Gain Tax Payment RPGT 5.

The bank will provide a GST invoice to you and you can claim the GST input tax. Income Tax Payment excluding instalment scheme 7. Approved Trader Scheme ATMS Scheme.

In Malaysia GST largely falls under 4 different categories. State code list under GST. Agriculture Fisheries and Livestock Industry revised as at 3 November 2015 Aviation Industry revised as at 02 November 2015 Approved Jeweler Scheme revised as at 03 November 2015 Approved Toll Manufacturer Scheme revised as at 3 March 2016 Approved Trader Scheme revised as at 12 January 2016 Relief for Second-Hand Goods Margin.

Trying to get tariff data. Imports under special scheme with no GST incurred eg. Buprenorphine INN codeine dihydrocodeine INN ethylmorphine and other specified INNs.

Gst Code List Malaysia Step By Step Document For Withholding Tax Configuration Sap Blogs - 90 or any other chapter assistive devices rehabilitation aids and other goods for disabled specified in list 3 appended to this schedule 25 25 5. Malaysias trade exports hit new high New Straits Times. Investigation Composite Instalment Payment.

Capital acquisition GST free item. In the service tax no input exemption mechanism is. Trade Balance figures in record levels UOB FXStreet.

Search by MSIC 2008 Code Please insert at least 3 digits.

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

How To Register For Gst Gst Guide Xero Nz

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

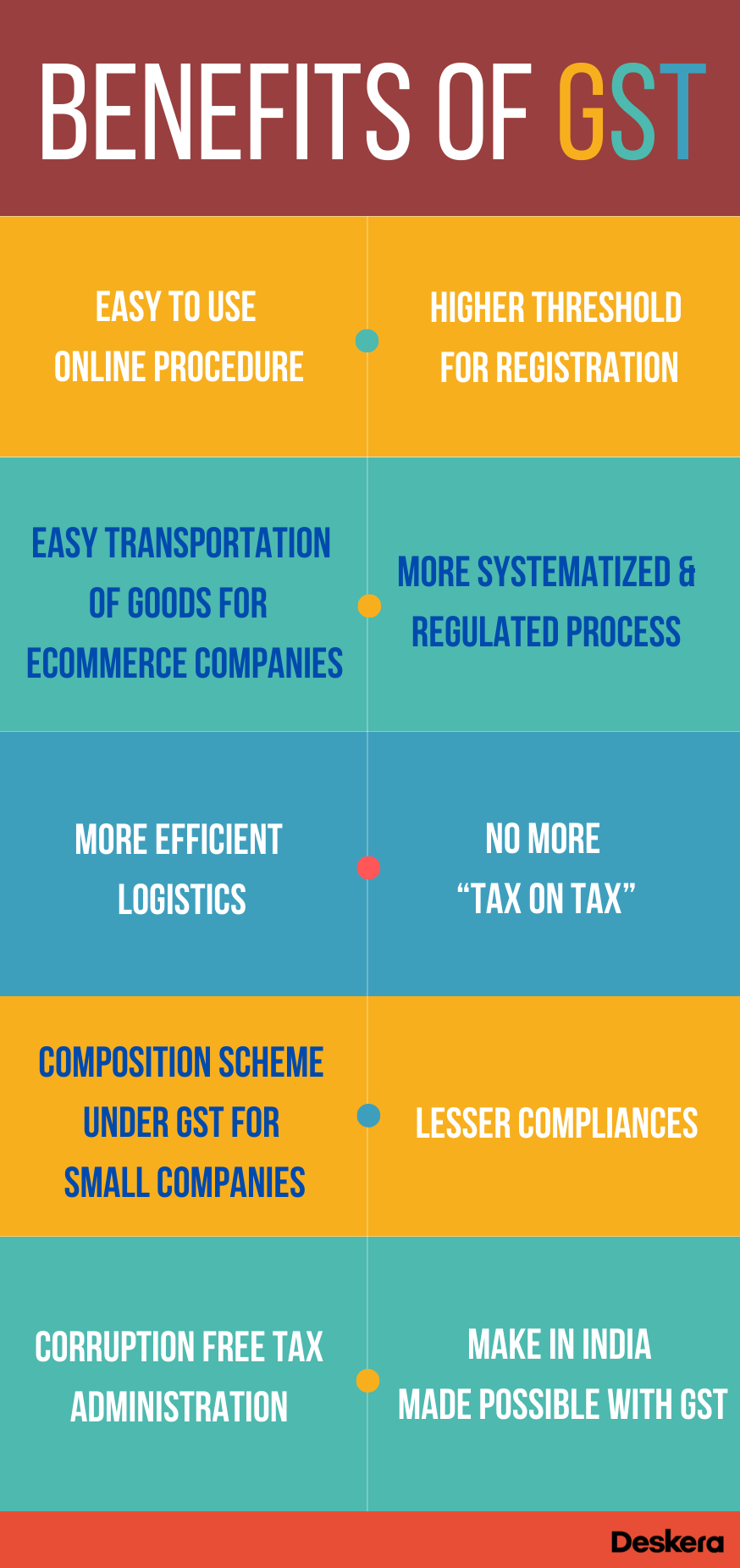

Gst Rates In 2022 List Of Goods Services Tax Rates Slabs And Revision

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

How To Issue Tax Invoice Agoda Partner Hub

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Basics Of Gst Tips To Prepare Gst Tax Invoice

Setting Up Taxes In Woocommerce Woocommerce

Chanel Sales Gst Black Caviar With Gold Hardware With Card Condition Good Rm 5990 Cash Price Promotion Only For Our Followers And Available At 114 Jalan

Gst Rate Hsn Code For Services

Casio G Shock Gst B200tj 1ajr G Steel Series 4549526268533 Ebay Casio Casio G Shock G Shock

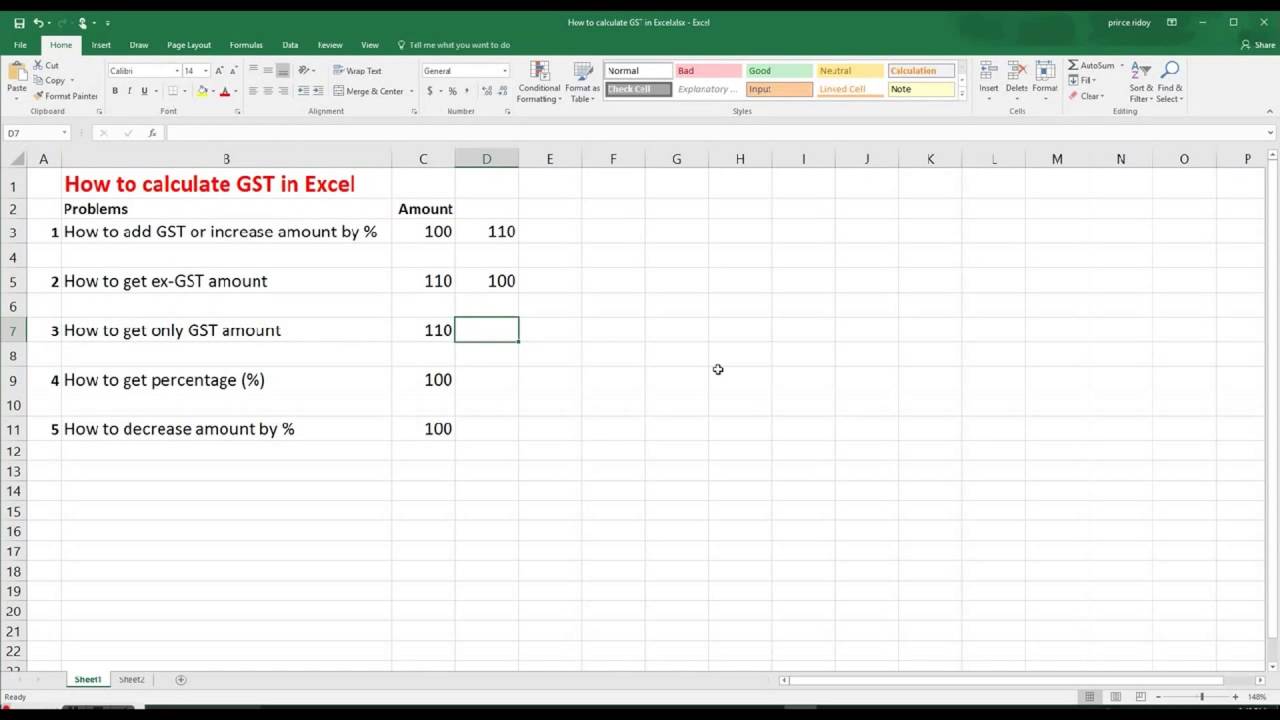

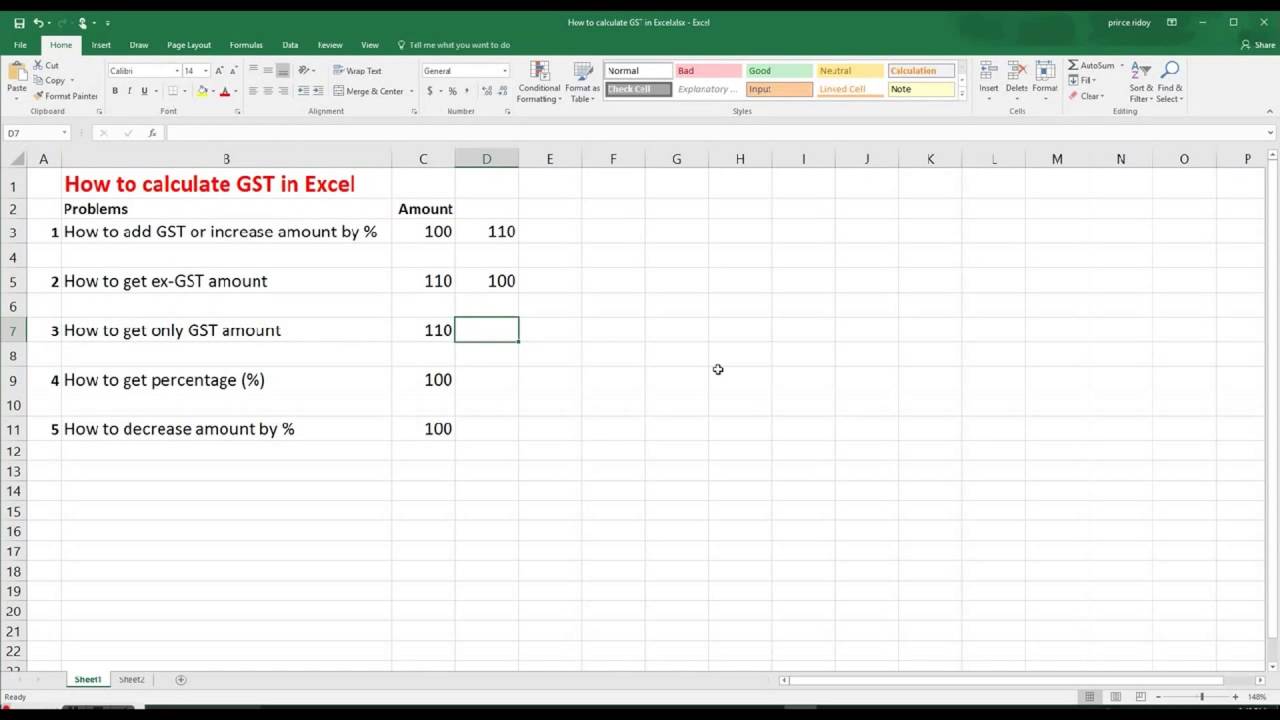

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

How To Issue Tax Invoice Agoda Partner Hub

Forever Living Products Price List Forever Living Products Forever Aloe Lips Health Quotes